How Home Ownership is Changing Life for Many Women

As Women's History Month comes to a close, we reflect on the impact women have in our lives, and that includes impact on the housing market. In fact, since at least 1981, single women have bought more homes than single men each year, and they make up 17% of all households.

A study showed that single women surpassed single men in homeownership back in 1985. At that time, about 42% of single men with no children were homeowners compared to 53.6% of women with no children. In 2015, 52.6% of single women with no children were homeowners compared to 46.2% of comparable men. When adding children to the mix, these numbers start to shift in favor of single men.

The National Association of Realtors' housing trends report showed that single women made up 22% of home buyers in 2020 with single men trailing at 9%. Surprisingly, a recent Yale study found that single women pay around 2% more when purchasing a house, and sell it for 2% less.

On the financial side, housing proves to be the key to building wealth for single women. Ksenia Potapov, Economist at First American, says:

“For single women, housing has always made up a large share of total assets. Over the last 30 years, the average single woman’s wealth has increased 88% on an inflation-adjusted basis, from just over $142,000 in 1989 to $267,000 in 2019, and housing has remained the single largest component of their wealth.”

The financial security and independence homeownership provides can be life changing, too. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

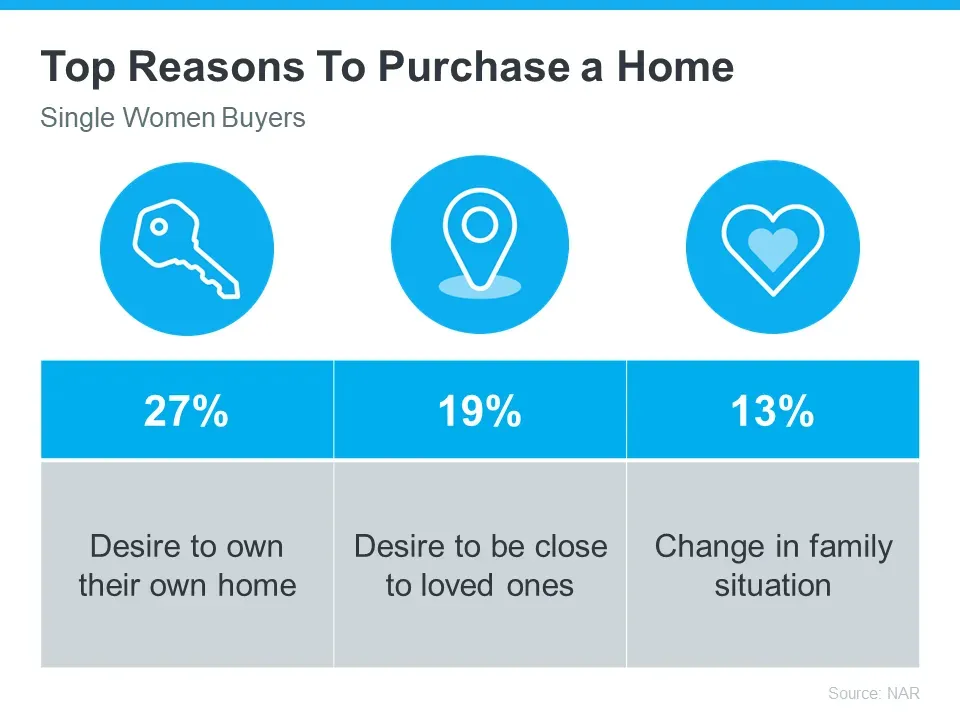

A recent report from the National Association of Realtors (NAR) shares the top reasons single women are buying a home right now (see chart below):

Share