Study shows buying 1st home younger creates better home equity & financial wealth at retirement.

According to a recent study by the Urban Institute, purchasing a home before the age of 35 better prepares one for retirement at age 60.

Using the Panel Study of Income Dynamics (PSID), a dataset that has followed US individuals since 1968, the Urban Institute study tracked people who reached age 60 between 2003 and 2015. The PSID switched to a biannual survey in 1997. The study relies on that data for those who were not surveyed at age 60. Their findings have surprising implications.

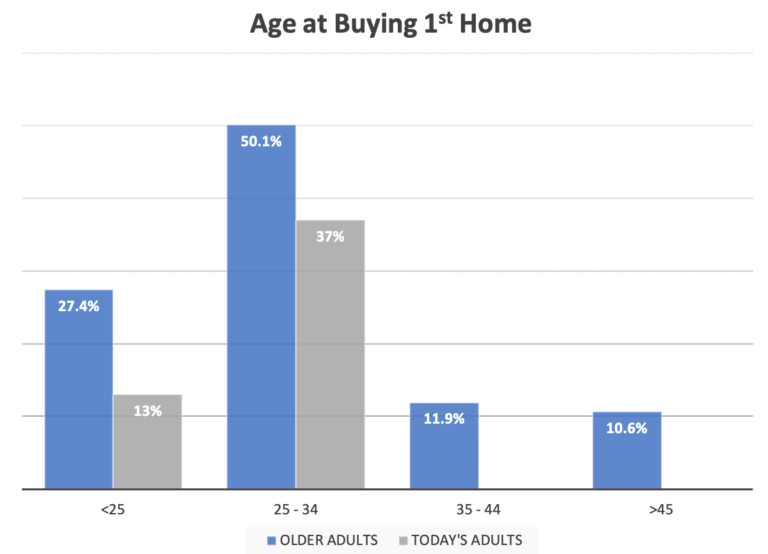

Most of today’s older homeowners bought their first homes before age 35, but that trend is changing.

How old were you when you bought your first home?

According to the study, today’s young adults are less likely to own a home compared with baby boomers and Gen Xers at the same age. The homeownership rate for millennials was 37 percent in 2015, or about eight percentage points lower than that of the two previous generations (Gen X and Baby boomers) at the same age.

Many housing experts are concerned that the homeownership rate amongst millennials, those 18-34, is much lower than previous generations in the same age range. There could be many reasons for this trend including: delayed marriage, greater racial diversity, higher education debt and delayed child bearing. Regardless of the reasons, the impact could be significant.

The study shows that those who bought their first homes when they were younger are in better financial health when nearing retirement. The study shows that those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60 with the home values at $190k. The buyers who purchased in their mid-twenties and early-30s had close to $50,000 left, but with homes valued closer to $240k – – giving both groups healthy home equity ($180k – $190k) at age 60 for retirement.

“Those who bought between ages 25 and 34 have the greatest housing wealth by their sixties. At age 60 or 61, their median home equity (in 2015 inflation-adjusted dollars) is close to $150,000.”

The bottom line is that today’s young adults are not building home equity (the largest single source of wealth), at the same rate as generations before them. The study asserts that deferring 1st time home purchases could have long-term economic consequences both for millennials and the nation as a whole.

Read the full article here.

For more research on “Millennial Homeownership” and why it’s lower than previous generations, read the full research study from the Urban Institute. You can download the report here.

Share