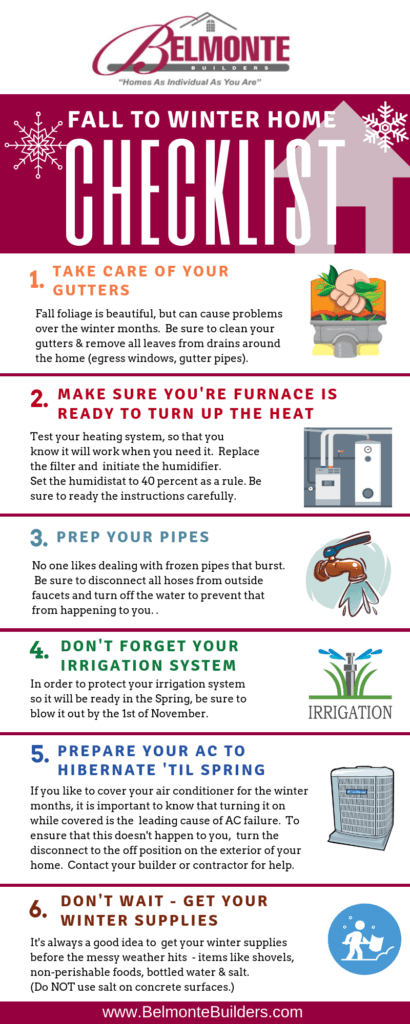

Making the Transition from Fall to Winter

As cold weather moves in, it is important to take a few preventative measures to protect your home. Winterizing isn’t typically expensive to do and usually doesn’t require much “handiness”, but it can make a real difference once cold weather hits. Use our “Fall to Winter Checklist” to be sure your home is ready for the freezing temperatures – by checking these basic things off before the snow flies, you’ll be saving yourself some hassle (and possibly some money, too!).

A few more additional items to check as well:

Check your Fireplace

- Animal nests or creosote buildup in your fireplace can be hazardous. Have an annual inspection before building your first fire of the season.

Weatherproof (especially if you own an older home)

- Weatherstripping or installing storm doors and windows will prevent cold air from entering your home or heat from escaping it, which will reduce your power bills.

- Caulk around windows and use foam outlet protectors to prevent cold air from entering your home. However, the majority of heat loss typically occurs via openings in the attic. Check to make sure that you have enough insulation

Protect Your Plants

- You’ll need to bring plants and flowering trees inside before the first cold snap. Typically, you should bring your plants in before temperatures dip below 45 degrees.

Bring in the Outdoors

- Cold temperatures, snow and ice can damage outdoor furniture and grills. If possible, store them in the garage or basement.

- If you have a gas grill with a propane tank, close the tank valve and disconnect the tank first. Clean & cover your grill before putting it away for the season.

Share